FHSA (First Home Savings Account) in Canada: Ultimate Guide for First-Time Buyers

Published on June 18, 2025 | By WealthFusions Team

FHSA at a Glance: Save Smart for Your First Home

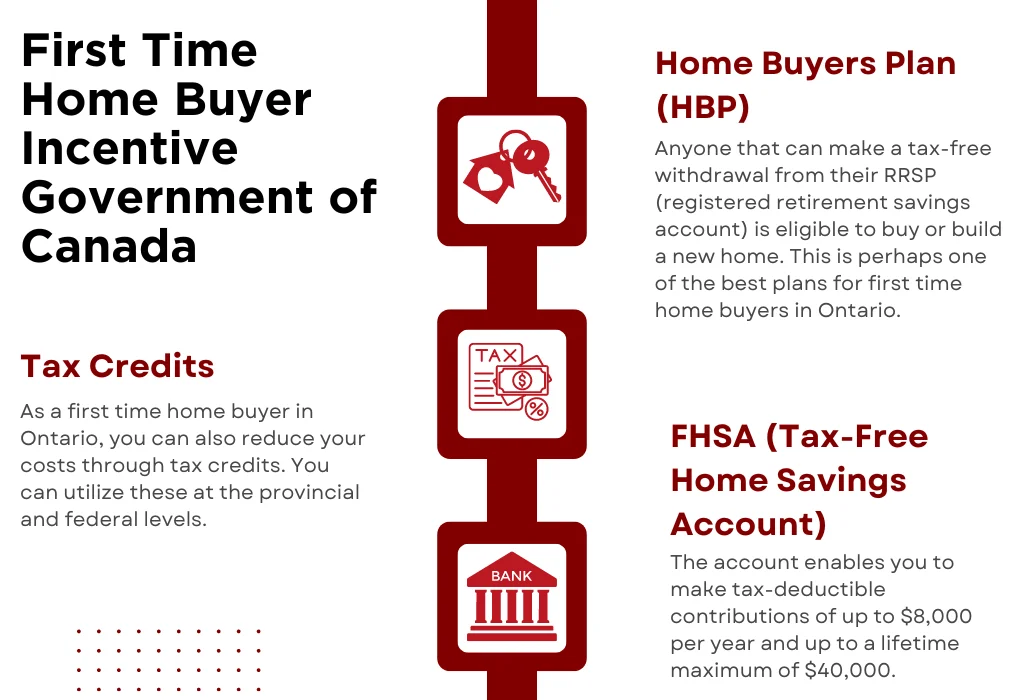

The First Home Savings Account (FHSA) offers Canadians a powerful new way to save for their first home—tax-free. Here’s what makes it special:

Tax-Deductible Contributions

Contribute up to $8,000/year and reduce taxable income—up to $40,000 lifetime total.

Tax-Free Withdrawals

Use funds to buy your first home without taxes or repayment—unlike the RRSP Home Buyers’ Plan.

15-Year Limit

You can keep an FHSA open for up to 15 years or until age 71—whichever comes first.

RRSP Transfers Allowed

You can transfer funds from your RRSP to FHSA without tax implications—up to your FHSA limit.

Investments Grow Tax-Free

Your FHSA can hold ETFs, stocks, GICs, and more—with no tax on gains when used for a home.

Who’s Eligible?

You must be a Canadian resident, 18+, and a first-time buyer (not owned a home in 4+ years).

Looking to buy your first home in Canada? The First Home Savings Account (FHSA) could be your best financial ally. Launched in 2023, the FHSA is a tax-free savings plan that combines the best features of an RRSP and TFSA. In this guide, we break down eligibility, contribution limits, withdrawal rules, and tax advantages—with real numbers, strategies, and comparisons to help you save smarter and reach your homeownership dream faster.

1. What Is the FHSA?

The First Home Savings Account (FHSA) is a registered plan that allows eligible Canadians to save up to $40,000 tax-free toward the purchase of their first home. It offers:

- Tax-deductible contributions (like an RRSP)

- Tax-free withdrawals for your first home (like a TFSA)

- Tax-sheltered investment growth on interest, dividends, and capital gains

2. Who Is Eligible to Open an FHSA?

To qualify, you must:

- Be a Canadian resident

- Be between 18 and 71 years old

- Be a first-time homebuyer (not owned a home in the past 4 years)

Tip: You can open multiple FHSAs with different institutions, but total contributions across all accounts must stay within the annual and lifetime limits.

3. FHSA Contribution Limits (2025)

| Year | Annual Contribution Limit | Lifetime Limit | Unused Room Carry Forward |

|---|---|---|---|

| 2023–2025 | $8,000/year | $40,000 | Yes, up to $8,000 |

Example: If you only contributed $5,000 in 2024, you can contribute $11,000 in 2025.

4. FHSA vs. RRSP vs. TFSA

| Feature | FHSA | RRSP (HBP) | TFSA |

|---|---|---|---|

| Tax-deductible contributions | ✅ | ✅ | ❌ |

| Tax-free withdrawals for home | ✅ | ✅ (must repay) | ✅ |

| Repayment required | ❌ | ✅ (within 15 years) | ❌ |

| Lifetime contribution limit | $40,000 | None | $95,000 (as of 2025) |

Pro Tip: Use the FHSA before dipping into your RRSP (HBP) to avoid repayment requirements.

5. Investment Options Inside an FHSA

You can hold similar investments as in a TFSA or RRSP, including:

- High-interest savings accounts

- Mutual funds

- ETFs (Exchange-Traded Funds)

- GICs (Guaranteed Investment Certificates)

- Stocks and Bonds

Example Strategy: For a 3-5 year homeownership goal, consider a mix of 60% GICs or bonds and 40% equity ETFs.

Maximize Your FHSA: 8 Smart Tips

Unlock the full potential of your First Home Savings Account with these key strategies for Canadians.

1. Confirm Eligibility

Neither you nor your partner has owned a home in the current or past 4 years.

2. Maximize Contributions

Contribute up to $8,000/year with a $40,000 lifetime limit; unused room carries forward.

3. Automate Savings

Set up automatic transfers to build savings steadily and benefit from dollar-cost averaging.

4. Combine with RRSP HBP

Use FHSA + RRSP Home Buyers’ Plan together to maximize your down payment funds.

5. Tax-Free Transfers

Transfer unused FHSA funds to RRSP/RRIF tax-free if not used for home purchase.

6. Family Gifting

Gift funds to family members to contribute and claim tax deductions.

7. Invest Smart

Choose investments aligned with your timeline—GICs for short-term, ETFs for longer horizons.

8. Avoid Over-Contributing

Track contributions carefully; penalties apply on excess amounts.

6. How Withdrawals Work

You can make a qualifying tax-free withdrawal if:

- You are a first-time buyer at the time of withdrawal

- You have a written agreement to buy or build a home in Canada before October 1 of the following year

- You intend to occupy the home within one year

Withdrawals not used for a qualifying home purchase will be taxed as regular income.

7. Combine FHSA and RRSP HBP

You can combine the FHSA and Home Buyers’ Plan (HBP) for a total down payment boost:

- FHSA: Up to $40,000

- RRSP HBP: Up to $35,000

- Total: Up to $75,000 (plus partner’s FHSA if applicable)

Couples can double that to $150,000 tax-free if both are first-time buyers and contribute fully.

8. What Happens If You Don’t Buy a Home?

If you don’t buy a home within 15 years of opening the FHSA (or by age 71), you must:

- Transfer to RRSP/RRIF tax-free (no impact on RRSP contribution room)

- Withdraw as income (taxable)

Best practice: roll to RRSP to continue tax sheltering your savings for retirement.

Conclusion & Action Steps

The FHSA is a game-changer for Canadian first-time homebuyers. With $40,000 in tax-free savings, no repayment rules, and investment flexibility, it should be your first choice when planning a down payment. Combine it with an RRSP and TFSA for maximum leverage.

Next step: Book a free strategy call with our advisor to optimize your FHSA investment and housing timeline.

Frequently Asked Questions

- 1. Can I open an FHSA if I already own property abroad?

- Yes, as long as you haven’t owned a home you lived in as your principal residence in Canada within the last 4 years.

- 2. Can I carry forward unused FHSA room?

- Yes, up to $8,000 in unused contribution room can be carried forward to the next year.

- 3. Is FHSA better than a TFSA for a home down payment?

- For first-time buyers, yes. FHSA offers tax deductions and tax-free withdrawals, unlike the TFSA which doesn’t provide upfront tax deductions.

- 4. Can I transfer funds from my RRSP to FHSA?

- Yes, tax-free transfers from RRSP to FHSA are allowed, but not tax-deductible again and count toward your FHSA limit.

- 5. Do I lose the FHSA room if I withdraw non-qualifying?

- Yes, and the withdrawal will be taxed. Only qualifying withdrawals are tax-free.

- 6. How do I open an FHSA?

- Open one online or in person with banks like RBC, TD, Wealthsimple, Questrade, or EQ Bank.

- 7. Can newcomers or permanent residents open an FHSA?

- Yes, if you are a Canadian tax resident and meet age and first-time buyer criteria.

- 8. Can I use FHSA funds for a rental or vacation home?

- No. It must be your principal residence intended for occupancy within 1 year of purchase.