Making an Insurance Claim in Canada: A Complete Step-by-Step Guide

Published on June 17, 2025 | By WealthFusions Insurance Experts

Accidents, illnesses, and damages can strike at any time—and knowing how to file an insurance claim can help reduce stress and get the support you need faster. Whether it’s auto, home, life, or health insurance, this guide walks you through every step of the claims process in Canada. We also include key tips, timelines, comparison tables, and expert advice to help you avoid delays or denials.

1. Understand Your Coverage Before You Claim

Before you file a claim, review your policy document to confirm:

- Type of coverage: What’s insured and what’s excluded?

- Deductible: How much will you pay out of pocket?

- Claim limits: Are there maximums per item, per year, or per incident?

- Waiting periods: Especially for health or critical illness insurance.

Example: Your car insurance may not cover theft if you only have basic liability.

2. Gather Key Documents & Evidence

Collect the required materials early to speed up processing:

- Home insurance: Photos of damage, receipts for items, police report if theft involved

- Auto insurance: Police report, accident report, repair estimates, dashcam footage if available

- Health insurance: Original medical bills, prescriptions, diagnosis reports

- Life insurance: Death certificate, claim form, proof of relationship

Tip: Take photos or scan all documents—you can upload them directly via your insurer’s portal or app.

3. Notify Your Insurer Promptly

Delays can hurt your chances of getting a claim approved. Each policy sets a deadline for reporting:

| Insurance Type | Typical Reporting Deadline | Late Penalty |

|---|---|---|

| Auto | Within 7 days | Claim denial or reduced payout |

| Home | Within 14 days | Delayed processing |

| Health | Within 90 days | Claim rejection after 12 months |

| Life | ASAP (no fixed deadline) | Longer processing if documents are incomplete |

Note: Most insurers now allow claims via mobile app, email, or website login.

4. Fill Out the Claim Form Accurately

Use your insurer’s official form (online or paper). Double-check:

- Policy number and contact details

- Date and description of the incident

- All supporting documentation

- Bank account info for direct deposit

Warning: Incomplete or inconsistent info may lead to claim rejection.

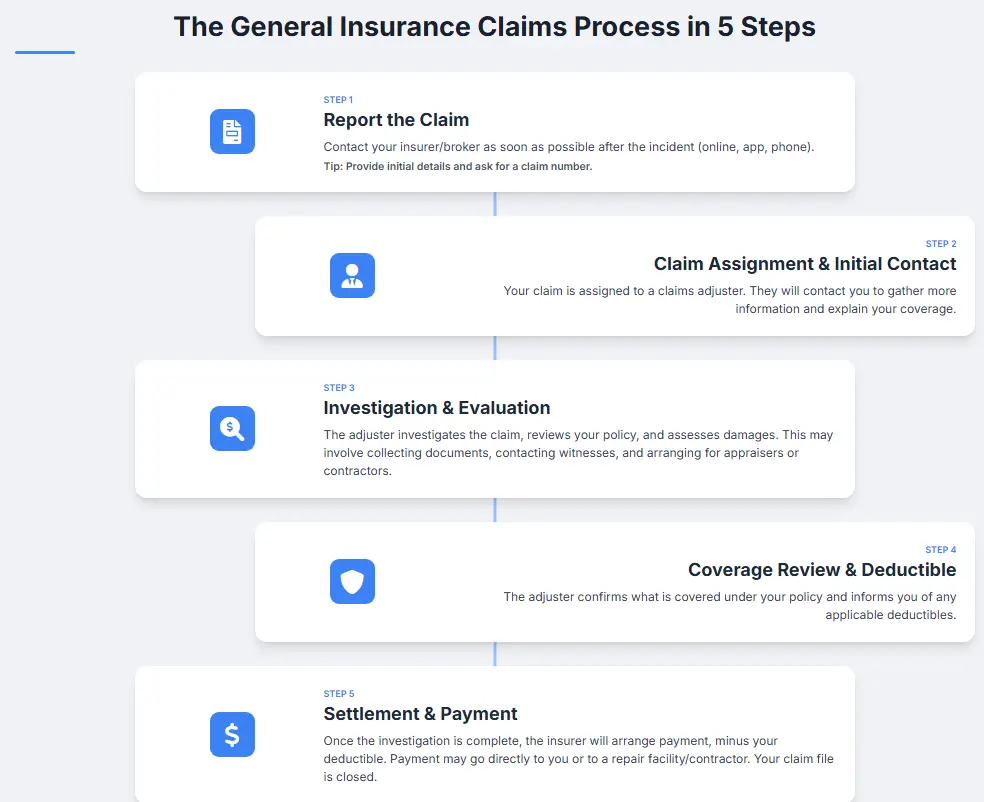

5. Cooperate During the Assessment Process

After you submit the claim:

- A claims adjuster may call, visit, or request an inspection

- You may be asked for more documents or witness statements

- Medical exams may be required for disability or life insurance claims

Tip: Keep a log of all communication (dates, names, notes).

6. Receive Your Payout or Reimbursement

Once approved, funds are typically paid via direct deposit or cheque. Expected timelines:

| Insurance Type | Average Processing Time |

|---|---|

| Auto | 7–15 business days |

| Home | 10–20 business days |

| Health | 5–10 business days |

| Life | 15–30 business days |

Important: You may need to approve a settlement before receiving funds.

7. Appeal If the Claim Is Denied

If your claim is denied, don’t panic. You have rights:

- Request the denial in writing, with reasons

- Submit additional documentation to support your case

- File a complaint with your insurer’s ombudsman

- Escalate to the Ombudsman for Banking Services and Investments (OBSI)

Tip: Keep copies of all letters and emails during the appeal process.

Conclusion

Making an insurance claim in Canada doesn’t have to be complicated. With the right documentation, timely action, and clear communication, you can maximize your payout and reduce delays. Each step—from knowing your coverage to following up on payments—matters.

Need help navigating your insurance claim? Contact WealthFusions for a free consultation today.

Frequently Asked Questions

- 1. What documents do I need to file a claim?

- This varies by insurance type but often includes ID, policy number, receipts, damage photos, police or medical reports.

- 2. Can I file a claim online?

- Yes. Most Canadian insurers offer claim submission through mobile apps, websites, or email.

- 3. How long do claims take to process?

- Health: 5–10 days. Auto: up to 2 weeks. Life: up to 30 days. Complex cases may take longer.

- 4. Will my premiums go up after a claim?

- Auto and home insurance premiums may rise after claims, especially if you’re found at fault.

- 5. What if my claim is denied?

- You can request a review, appeal internally, or escalate to an external ombudsman or regulator.

- 6. Can I claim insurance for minor damage?

- Yes, but it may not be worth it if the cost is below or close to your deductible.

- 7. Who pays first—insurance or me?

- You usually pay upfront and get reimbursed, unless it’s a direct bill arrangement (common with dental/health).

- 8. How can I track my claim?

- Most insurers offer claim tracking online or via mobile app. You can also contact your adjuster for updates.