Income Protection Insurance in Canada: Secure Your Paycheque

Published on June 17, 2025 | By WealthFusions Insurance Desk

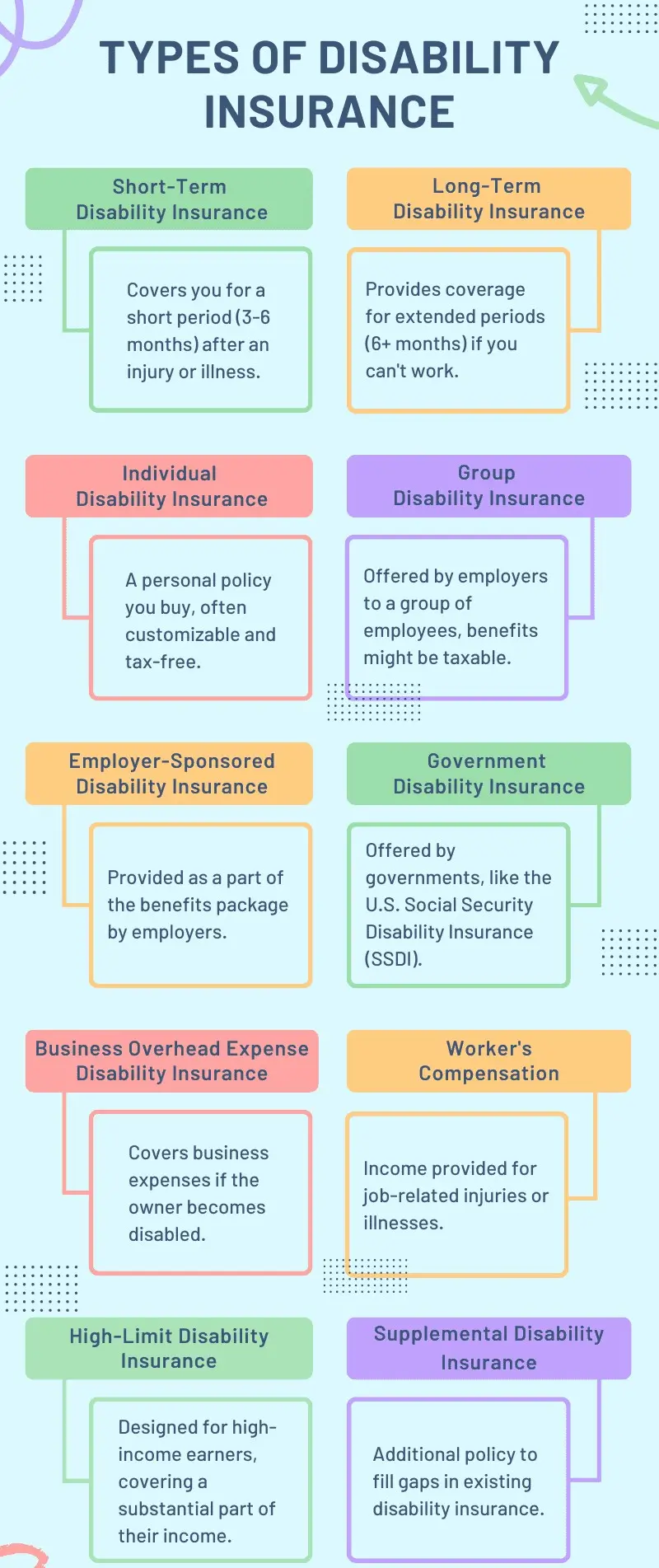

What would happen if you suddenly couldn’t work due to illness or injury? That’s where Income Protection Insurance comes in. In Canada, this essential coverage helps replace your income when you’re unable to earn, ensuring your bills, mortgage, and daily expenses are still covered. In this in-depth guide, we’ll explore what it is, how it works, the types of coverage available, who needs it, and how to choose the right plan for your lifestyle and budget.

What Is Income Protection Insurance?

Also known as Disability Insurance, this policy pays a monthly benefit if you can’t work due to illness, injury, or accident. It typically replaces 60% to 85% of your pre-tax income, depending on your plan and provider.

Example: If you earn $5,000/month, a policy may pay $3,500 to $4,250/month while you recover.

Short-Term vs Long-Term Income Protection

| Feature | Short-Term Disability (STD) | Long-Term Disability (LTD) |

|---|---|---|

| Coverage Period | Up to 6 months | 2 years to age 65 |

| Elimination Period | 7 to 14 days | 30 to 180 days |

| Replacement Rate | 60–75% | 60–70% |

| Use Case | Broken bones, short illness | Cancer, chronic illness, major injury |

Who Needs Income Protection Insurance?

While many believe it’s only for the self-employed, the truth is any working Canadian should consider this coverage. Here’s who benefits most:

- Self-employed and gig workers – no employer plan to fall back on.

- Families with one primary earner – income loss can cripple finances.

- Homeowners – mortgage still needs to be paid monthly.

- Young professionals – higher risk tolerance, but longer income years to protect.

Stat: According to RBC Insurance, 1 in 3 Canadians will be disabled for 90+ days before age 65.

How Much Does It Cost?

Premiums vary based on age, gender, health, occupation, and coverage features. On average:

- Age 30, Non-smoker, $3,000/month benefit: ~$40–$70/month

- Age 45, $5,000/month benefit, with riders: ~$90–$150/month

Tip: Buying at a younger age locks in lower premiums and guarantees insurability even if your health changes later.

Key Features to Look For

Not all plans are created equal. Look for these features when comparing policies:

- Own Occupation Coverage: Pays benefits if you can’t perform your current job—even if you can work in another.

- Indexing (COLA): Adjusts benefit for inflation annually.

- Partial Disability: If you can return part-time, you still get partial benefits.

- Return-to-Work Support: Includes vocational rehab or training.

Employer vs Private Disability Plans

| Feature | Group Plan (Employer) | Private Plan |

|---|---|---|

| Portability | No (ends when job ends) | Yes (follows you) |

| Customizable | Limited options | Highly customizable |

| Taxable Benefits | Yes (if premiums paid by employer) | No (if paid by you personally) |

| Underwriting | None or limited | Full medical underwriting |

Conclusion: Is Income Protection Worth It?

If losing your income would cause financial hardship, income protection insurance is not optional—it’s essential. It bridges the gap between your financial responsibilities and life’s unexpected challenges. Evaluate your existing benefits, then compare private plans for added peace of mind.

Get a free income protection quote now and safeguard your earnings today!

Frequently Asked Questions

- 1. Is income protection insurance the same as critical illness insurance?

- No. Income protection pays monthly for loss of income due to any illness or injury; critical illness pays a lump sum for specific conditions.

- 2. What’s the elimination period?

- The waiting period before benefits start (e.g., 30 or 90 days). Longer periods = lower premiums.

- 3. Can I have both group and private disability insurance?

- Yes! A private plan can top up your group plan or provide portability if you leave your job.

- 4. Is the benefit taxed?

- If you pay premiums personally, the benefit is generally tax-free in Canada.

- 5. Can I increase my benefit later?

- Yes, if you include a future increase option (FIO) rider when buying your policy.

- 6. Does it cover mental health conditions?

- Yes, most plans cover depression, anxiety, and other mental health-related disabilities.

- 7. What if I’m self-employed?

- Income protection is crucial for self-employed individuals with no workplace benefits.

- 8. What happens when I recover?

- You’ll stop receiving benefits, but some plans offer rehabilitation support to help you return to work safely.