How Credit Cards Work: A Beginner’s Guide for Canadians

Published on June 17, 2025 | By WealthFusions Finance Team

Credit cards are a powerful financial tool, but understanding how they work is essential to avoid debt and maximize benefits. In Canada, millions use credit cards daily for convenience, rewards, and building credit history. This guide breaks down the fundamentals—billing cycles, interest rates, fees, rewards, and tips—using data and examples tailored for Canadians. Whether you’re applying for your first card or looking to optimize your spending, this article will make credit cards easy to understand and work for you.

1. The Basics: What Is a Credit Card?

A credit card is a revolving line of credit offered by banks or financial institutions, allowing you to borrow money up to a set limit to make purchases or cash advances.

- Credit limit: The max amount you can borrow; typically ranges from $500 to $20,000+ depending on credit score and income.

- Billing cycle: Usually 30 days. Your statement shows all charges made during this period.

- Payment due date: Typically 21 to 25 days after the statement date—pay by then to avoid interest.

2. How Interest Works on Credit Cards

Interest is charged only on balances carried past the due date, not on new purchases if you pay in full.

| Type | Typical Annual Interest Rate (APR) | Details |

|---|---|---|

| Purchase APR | 19% – 22% | Applies if balance is not fully paid by due date |

| Cash Advance APR | 21% – 25% | Interest starts immediately, no grace period |

| Balance Transfer APR | 0% – 5% Intro (then ~20%) | Promotional rate for transferring balances from other cards |

Example: If you carry a $1,000 balance at 20% APR, you pay about $16.67 monthly interest ($1,000 × 20% / 12).

3. Billing Cycle and Grace Period

Your billing cycle (usually 30 days) is followed by a grace period (typically 21–25 days). If you pay the full statement balance within the grace period, you avoid interest on purchases.

- Miss the payment? Interest starts accruing on the balance from the transaction date.

- Partial payment? Interest accrues on remaining balance plus new purchases.

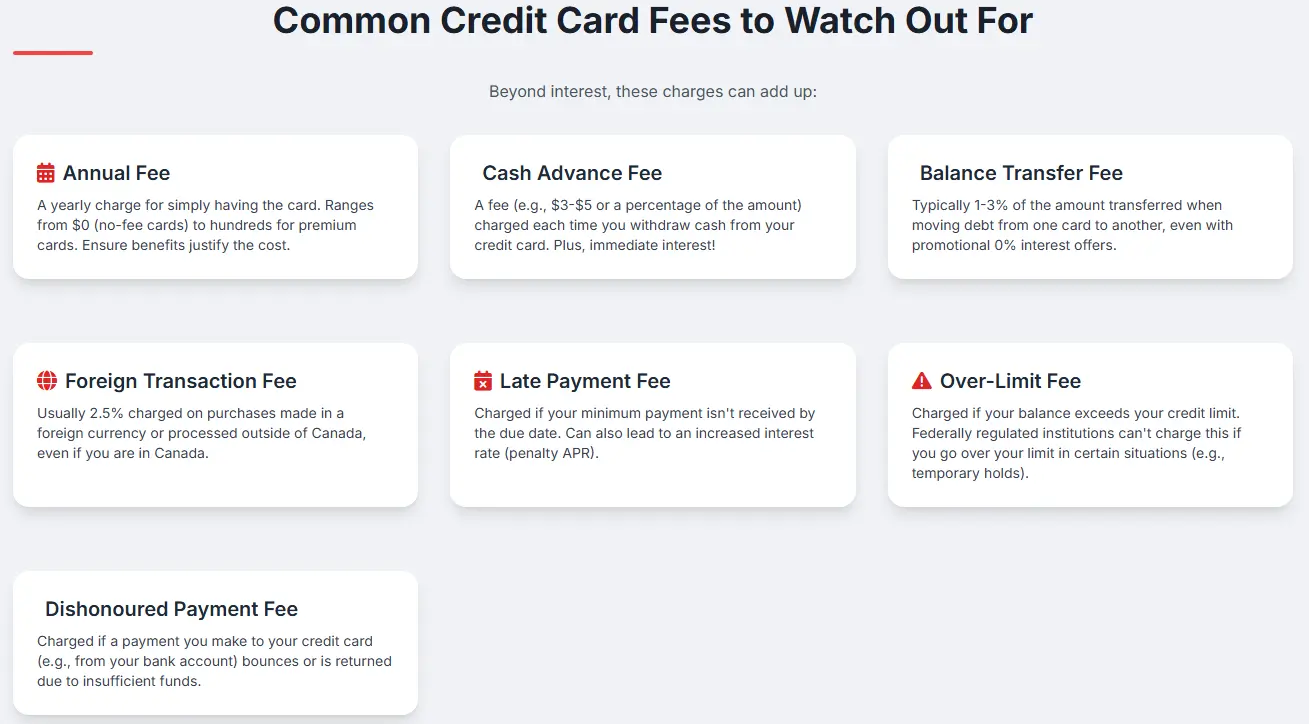

4. Fees You Should Know

Common credit card fees in Canada:

- Annual fee: $0 to $150+, depending on card perks.

- Late payment fee: $30–$40 per missed payment.

- Over-limit fee: Rare, but can be $25–$50.

- Foreign transaction fee: Usually 2.5% on purchases made outside Canada.

- Cash advance fee: 2.5% – 3% of amount withdrawn, plus immediate interest.

5. Building Your Credit Score with Credit Cards

Using credit cards responsibly helps build your credit score, vital for mortgages, loans, and rentals. Key tips:

- Pay on time every month.

- Keep credit utilization under 30%: If your limit is $5,000, keep balances below $1,500.

- Keep older cards open: Longer credit history boosts your score.

- Limit new applications: Multiple hard inquiries can lower your score.

6. Rewards & Benefits: Choosing the Right Card

Many cards offer rewards like cashback, travel points, or insurance. Here are some popular Canadian credit card types:

| Card Type | Typical Rewards | Annual Fee | Best For |

|---|---|---|---|

| Cashback | 1–5% on purchases | $0 – $120 | Everyday spending |

| Travel Rewards | Points redeemable for flights/hotels | $0 – $150+ | Frequent travelers |

| Low Interest | Lower APR (around 12–15%) | $0 – $50 | Carrying balance |

| Student Cards | Lower limits, some rewards | Usually $0 | Students building credit |

7. Tips for Using Credit Cards Responsibly

- Pay your balance in full every month to avoid interest.

- Set up automatic payments to avoid late fees.

- Use rewards cards strategically, but don’t overspend to earn points.

- Check your statements regularly for unauthorized transactions.

📋 How to Apply for a Credit Card in Canada: Step-by-Step

1️⃣ Research & Choose Your Card

Compare rewards, fees, and interest rates. Pick a card that matches your spending habits and goals.

2️⃣ Check Eligibility

Make sure you meet requirements: age (18/19), Canadian residency, income, and sometimes credit score.

3️⃣ Gather Required Info

You’ll need ID, SIN, employment status, income, address, and contact details.

4️⃣ Apply Online or In-Branch

Fill out the application form accurately and submit it online or visit a branch.

5️⃣ Wait for Approval

Approval can be instant or take a few days. If denied, you’ll get a reason and can reapply later.

6️⃣ Receive & Activate Card

Your card will arrive by mail. Activate it online or by phone before you start using it.

Need help choosing a credit card? visit today

8. How to Apply and What You Need

To apply for a Canadian credit card you typically need:

- Valid ID (passport, driver’s license)

- Proof of income (pay stubs, tax returns)

- Social Insurance Number (SIN)

- Credit history (newcomers may apply with alternative documentation)

Applications can be completed online in minutes, and approval can be instant or take a few days.

Conclusion & Next Steps

Understanding how credit cards work is the first step toward smart money management and building a strong credit profile in Canada. Choose a card that fits your spending habits and financial goals, pay on time, and monitor your usage carefully. If you want personalized help picking the best card or managing your credit, visit today with our experts today.

Frequently Asked Questions

- 1. What happens if I only pay the minimum amount?

- You will accrue interest on the remaining balance, making your debt grow and increasing total repayment time.

- 2. How is my credit limit determined?

- Based on your income, credit history, and credit score, lenders set a maximum borrowing limit.

- 3. Can I increase my credit limit?

- Yes, typically after 6–12 months of responsible use, you can request a higher limit.

- 4. What is a grace period?

- It’s the time between the statement date and payment due date when no interest is charged if the full balance is paid.

- 5. Are all credit cards accepted everywhere?

- Most are Visa or Mastercard, widely accepted; some (like American Express) may have more limited acceptance.

- 6. What if I lose my card?

- Report it immediately to your issuer to block unauthorized transactions and request a replacement.

- 7. How do rewards points work?

- Points accumulate based on spending and can be redeemed for travel, cashback, or merchandise depending on the program.

- 8. Can I have more than one credit card?

- Yes, but manage them carefully to avoid overspending and maintain a good credit score.