Pre-Authorized Debits Canada: 8 Key Facts You Must Know

Published on June 16, 2025 | By WealthFusions Finance Team

Pre-Authorized Debits Canada provide a secure and automated way to pay recurring bills such as utilities, loans, insurance, and subscriptions. This comprehensive guide will help you understand how PADs work in Canada, setup tips, benefits, fees, dispute rights, and how to protect your finances when using PADs.

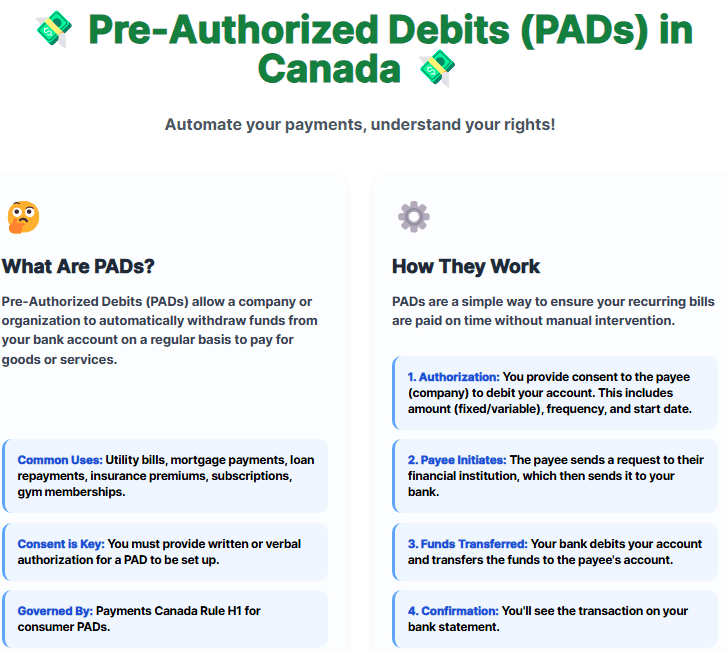

1. What Are Pre-Authorized Debits Canada Residents Should Know?

PADs are electronic withdrawals from your bank account, scheduled by a payee with your consent. Under the Canadian Payments Act and CPA rules:

- You provide a one‑time or recurring PAD agreement.

- Your bank processes withdrawals on specified dates (e.g., 1st of each month).

- You have rights to dispute unauthorized or incorrect debits within 90 days.

2. Common Uses & Benefits of Pre-Authorized Debits Canada

- Utilities: Hydro, water, gas.

- Loans & Mortgages: Principal and interest on time.

- Insurance: Auto, home, life premiums.

- Subscriptions: Gym, streaming services.

Benefit snapshot: Automated payments reduce late fees (average $15 each) and protect credit scores by ensuring on‑time payments.

3. Fees & Overdraft Risks with PADs in Canada

| Scenario | Bank Fee | Overdraft Fee | Example Cost |

|---|---|---|---|

| Insufficient Funds | $0 | $5–$6/day | $6 × 3 days = $18 |

| Returned PAD | $45 | $0 | One‑time $45 NSF fee |

| Unauthorized Debit | $0 | $0 | Dispute via bank — no cost |

Data based on average fees at major Canadian banks (RBC, TD, Scotiabank).

4. How to Set Up Pre-Authorized Debits Canada

- Obtain a PAD form from the payee (paper or online).

- Provide:

- Your institution number, transit number, and account number

- Authorization for one‑time or recurring debits

- Start date and frequency (e.g., monthly, bi‑weekly)

- Return the form or complete online instructions.

- Verify test amounts (micro‑deposits) if required by your bank.

5. Managing & Cancelling Pre-Authorized Debits Canada

- Contact the payee directly (written notice 10 days before next debit).

- Notify your bank to stop future debits (written or online instruction).

- Allow 30 days for bank processing—monitor account to confirm.

6. Dispute & Refund Rights for PADs in Canada

- Unauthorized debit: Full refund if claimed within 90 days.

- Incorrect amount: Refund of the difference within 10 business days.

- Late refund: Claim escalates to bank ombudsman or CPA.

7. Best Practices & Security for Pre-Authorized Debits Canada

- Review statements monthly—verify PAD amounts and dates.

- Set account alerts for debits > $100.

- Maintain a small buffer balance ($200+) to avoid overdrafts.

- Use strong online banking credentials and enable two‑factor authentication.

8. Choosing the Right Account for Pre-Authorized Debits Canada

| Account Type | Monthly Fee | NSF Fee | Overdraft Protection |

|---|---|---|---|

| Basic Chequing | $4.00/mo | $45 | Optional LOC (prime+2%) |

| No‑Fee Online | $0 | $45 | Linked savings only |

| Premium Bundle | $15.95/mo | $0 (waived) | Up to $1,000 free |

Conclusion & Next Steps

Pre-Authorized Debits Canada are a powerful tool to automate bills and subscriptions—but they require careful setup and monitoring to avoid costly fees. Follow our guide to choose the right account, maintain proper balances, and assert your refund rights if things go away.

visit this page? to get updated with the changing situation.

Frequently Asked Questions

- 1. Can I stop a PAD immediately?

- You must provide at least 10 days’ notice to the payee and instruct your bank; allow up to 30 days to process.

- 2. Is there a fee to set up a PAD?

- No—banks do not charge setup fees for PADs; however, failed debits incur NSF charges.

- 3. How long does a PAD authorization last?

- Recurring PADs remain until you cancel; one‑time PADs expire after the specified date.

- 4. What if a merchant debits more than agreed?

- You can dispute within 90 days for full refund; banks must investigate within 10 business days.

- 5. Do PADs show on my statement?

- Yes—each PAD appears with the merchant name, date, and amount.

- 6. Can I use PADs for rent payments?

- Yes—many landlords offer PAD options; confirm timing and amount with your property manager.

- 7. Are PADs safer than credit cards?

- PADS debit your bank account directly; unauthorized charges are disputable, but credit cards offer stronger chargeback protections.

- 8. How do I prove I canceled a PAD?

- Keep copies of written notices (email or mail) and bank stop-payment confirmations.