Infinite Banking in the USA: 5 Benefits of Becoming Your Own Bank

Published on June 21, 2025 | By WealthFusions Financial Experts

Infinite Banking in the USA: Become Your Own Bank & Unlock Financial Freedom

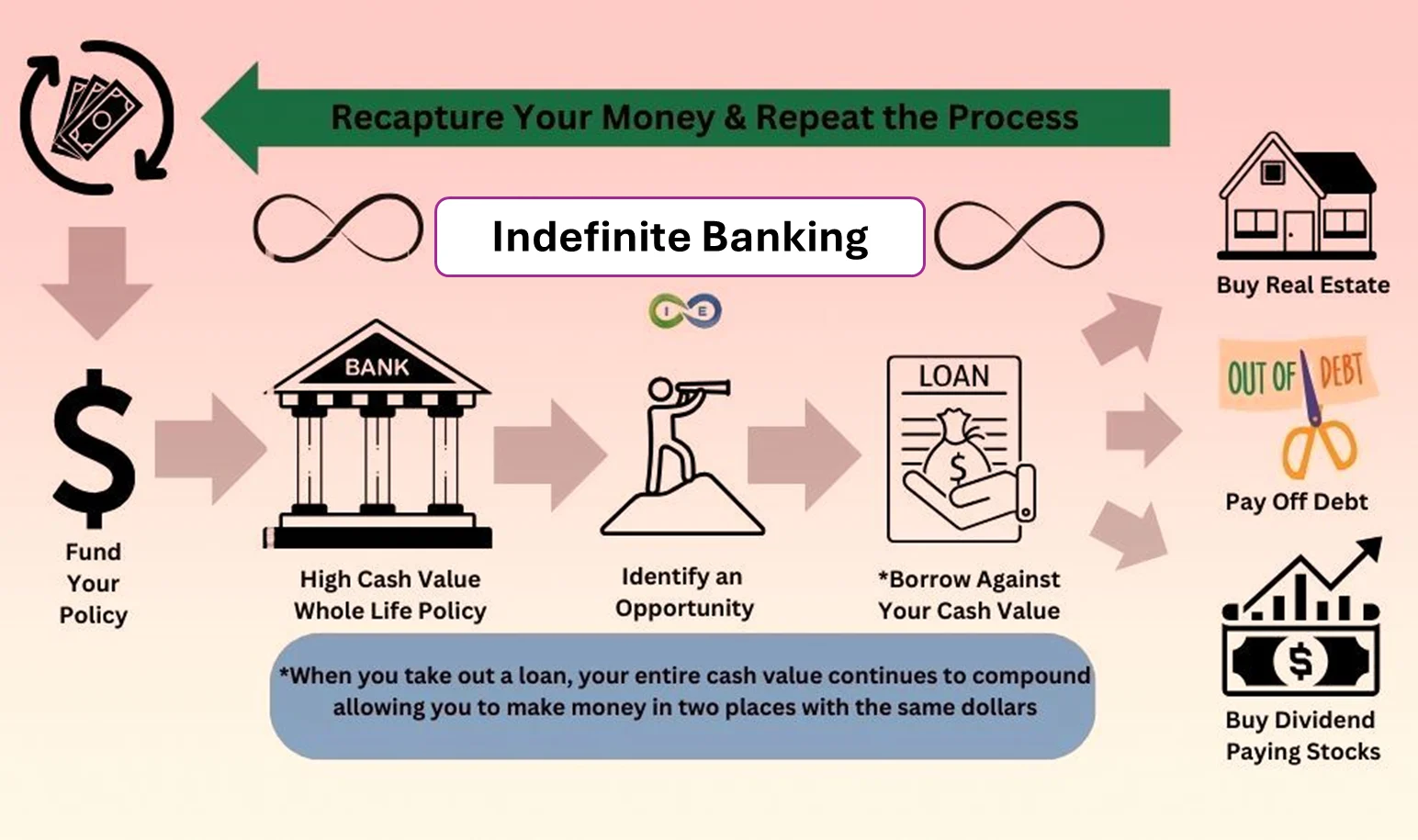

Infinite Banking is a personal finance strategy using specially designed whole life insurance policies that let you borrow against your own cash value—acting like your own bank. This method empowers you to build wealth, access funds anytime, and minimize reliance on traditional banks.

Benefits of Becoming Your Own Bank

- Control Your Money: Access policy cash value without credit checks or approvals.

- Tax Advantages: Tax-deferred growth of cash value and tax-free policy loans.

- Build Wealth: Cash value grows steadily, helping you save and invest.

- Borrow for Any Purpose: Use funds for investments, emergencies, or big purchases.

- Flexible Repayment: Repay loans on your schedule, avoiding penalties.

- Legacy Benefits: Life insurance payout provides security to your heirs.

How to Use Infinite Banking Effectively

- Purchase a Participating Whole Life Insurance Policy: Choose a policy from a reputable insurer that builds cash value and pays dividends.

- Build Cash Value: Pay premiums consistently to grow the cash value over time.

- Borrow Against Cash Value: Take policy loans for expenses like buying a car, investing in real estate, or funding education.

- Repay Loans When Able: Return the money on your timeline to replenish your “bank” for future use.

- Repeat and Grow: Use the strategy repeatedly, letting cash value compound and increasing your financial flexibility.

Is Infinite Banking Right for You?

This strategy suits those who want long-term financial control, steady growth, and tax benefits. It requires discipline, patience, and working with knowledgeable insurance professionals to tailor policies properly.

Start small, stay consistent, and watch your personal banking system grow.

Infinite Banking in the USA is a powerful financial strategy that lets you become your own bank—accessing funds anytime, growing wealth tax-free, and leaving a legacy. By leveraging dividend-paying whole life insurance, you can unlock long-term control over your finances. In this in-depth guide, we’ll explore how it works, key benefits, real-world examples, and whether it’s right for your financial goals.

What is Infinite Banking in the USA?

Infinite Banking is a concept popularized by R. Nelson Nash in his book “Becoming Your Own Banker.” It involves using a specially structured participating whole life insurance policy to create your own personal banking system.

Rather than borrowing from traditional banks, policyholders borrow against the cash value of their insurance, while the policy continues to earn interest and dividends. It’s often referred to as Bank on Yourself or the Private Reserve Strategy.

| Feature | Traditional Bank | Infinite Banking Policy |

|---|---|---|

| Loan Approval | Credit check required | No credit check |

| Loan Repayment Terms | Fixed, mandatory | Flexible, optional |

| Interest Earned | ~0.01% savings APY | 4–6% dividend + guaranteed growth |

| Tax Implications | Taxable interest | Tax-deferred growth, tax-free loans |

How Does Infinite Banking Work in the USA?

The process generally includes the following steps:

- Purchase a whole life policy from a mutual company (MassMutual, Guardian, Lafayette Life).

- Overfund the policy to rapidly grow the cash value.

- Borrow against the cash value using tax-free policy loans.

- Repay loans on your terms or let them reduce the death benefit.

Even when borrowed against, the entire cash value continues to grow as if untouched.

Key Benefits of Infinite Banking in the USA

- Tax-Free Loans: Access your money at any time without taxes or penalties.

- Guaranteed Growth: Cash grows at a fixed rate (3–4%) plus dividends.

- No Market Risk: Your money is shielded from stock market volatility.

- Legacy Planning: Tax-free death benefit for your heirs.

- Privacy: Policy loans are private and not reported to credit bureaus.

Risks and Drawbacks of Infinite Banking

- High Initial Costs: It can take 5–7 years to break even.

- Policy Lapse Risk: Poor loan management can trigger taxes.

- Not for Everyone: Requires discipline and cash flow.

- Complex Setup: Must be structured by a knowledgeable advisor.

Real-Life Infinite Banking Use Cases in the USA

- Business Owners: Use policy loans for capital or payroll.

- Real Estate Investors: Fund down payments or renovations.

- College Savings: Tax-free education funding alternative to 529 plans.

- Retirement Planning: Tap policy loans as tax-free retirement income.

The Process of Infinite Banking with Life Insurance

- Step 1: Establish a Whole Life or Universal Life Insurance Policy — Choose the policy that best suits your needs based on whether you want fixed premiums (Whole Life) or flexible premiums (Universal Life).

- Step 2: Overfund the Policy — Contribute extra premiums, especially in the early years, to build up significant cash value quickly.

- Step 3: Let the Cash Value Grow — As the cash value grows, your wealth grows tax-deferred, with the flexibility to borrow from it whenever you wish.

- Step 4: Borrow Against the Cash Value — When you need to make a major purchase (e.g., car, home, business investment), you borrow against your policy’s cash value at low-interest rates.

- Step 5: Repay the Loan — Repay the loan on your terms. You may pay interest only or repay the full balance, but this allows for continued cash value growth.

- Step 6: Repeat the Process — Continue using the policy to finance future expenses, build wealth, and maintain your financial freedom.

Visual Guide: How Infinite Banking in the USA Works

Need a quick breakdown? Watch this short explainer:

Is Infinite Banking in the USA Right for You?

Infinite Banking in the USA can be a powerful wealth-building tool when used correctly. It’s ideal for long-term planners like entrepreneurs, high earners, and families looking for tax-advantaged legacy solutions.

Ready to explore your options? Book a strategy session below.

Book a free 30-minute consultation with our insurance experts »

FAQs About Infinite Banking in the USA

- Is Infinite Banking legal in the USA?

- Yes, it is fully legal and IRS-compliant when structured properly with a whole life insurance policy.

- Can I lose money?

- You can if you surrender the policy early or mismanage loans. Structured correctly, risk is low.

- Best companies?

- Top mutual insurers include MassMutual, Guardian, Lafayette Life, and Penn Mutual.

- When can I borrow?

- Typically 30–90 days after policy funding.

- Are policy loans taxable?

- No, loans are tax-free as long as the policy is active.